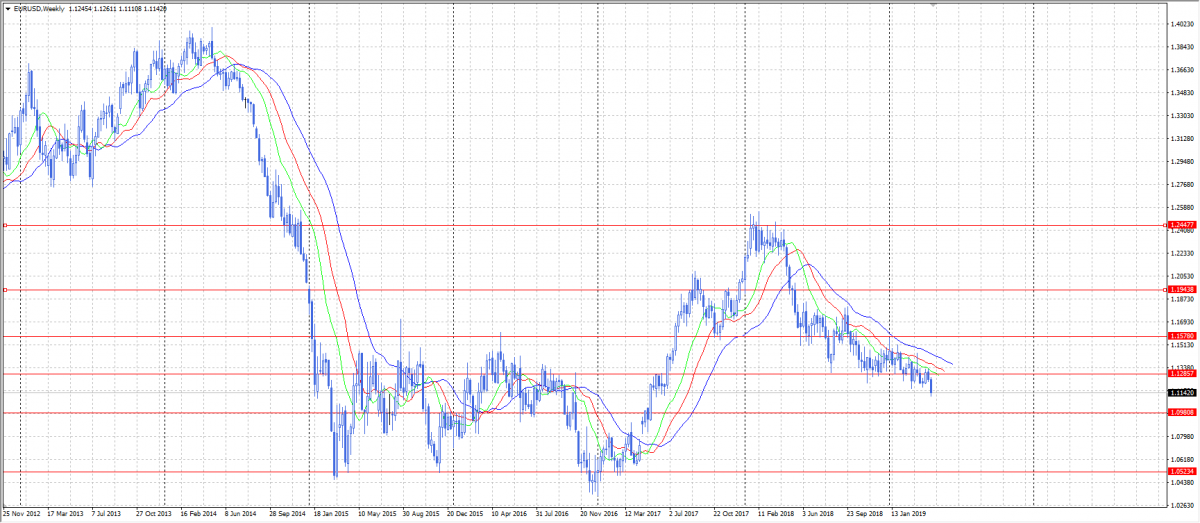

The currency pair developed its downtrend last week after testing the resistance at 1,1285. This downtrend is directly connected to stronger USD positions. We think that this is due to both macroeconomic data and low after holiday volumes.

German Ifo Business Climate declined to 99,2 as compared to previous 99,7. Economists expected some growth towards 99,9.

Spanish Unemployment Rate increased to 14,7%. Previous reading was 14,5%. Economists expected that the indicator will stay unchanged.

US Core Durable Goods Orders increased to 0,4%. Previous reading was -0,1%. As for the US GDP data, it increased to 3,2% from 2,2% which was significantly better than expected.

What to expected from EUR/USD this week? As you can see it on the Weekly chart, the currency pair is likely to develop its downtrend towards 1,0980. This scenario is the most probable. However, there is another one, when the currency pair reverses towards 1,1285. But this scenario is a secondary one.