The currency pair went upwards last week according to our expectations. However, this upside tendency ended on the psychologic 1,1200 level. The reason for this brief USD weakness was in weak Monday’s Us data and the continuation of the trade war between the US and China.

The US Non-Manufacturing PMI ISM declined to 53,7. Economists expected the indicator to grow towards 55,5. Previous reading was 55,1. This indicator influenced USD significantly as the Fed is criticized by the US President.

Euro is still under the pressure. ECB is likely to take further easing steps in the nearest future. This is why we do not expect some serious growth from the currency pair.

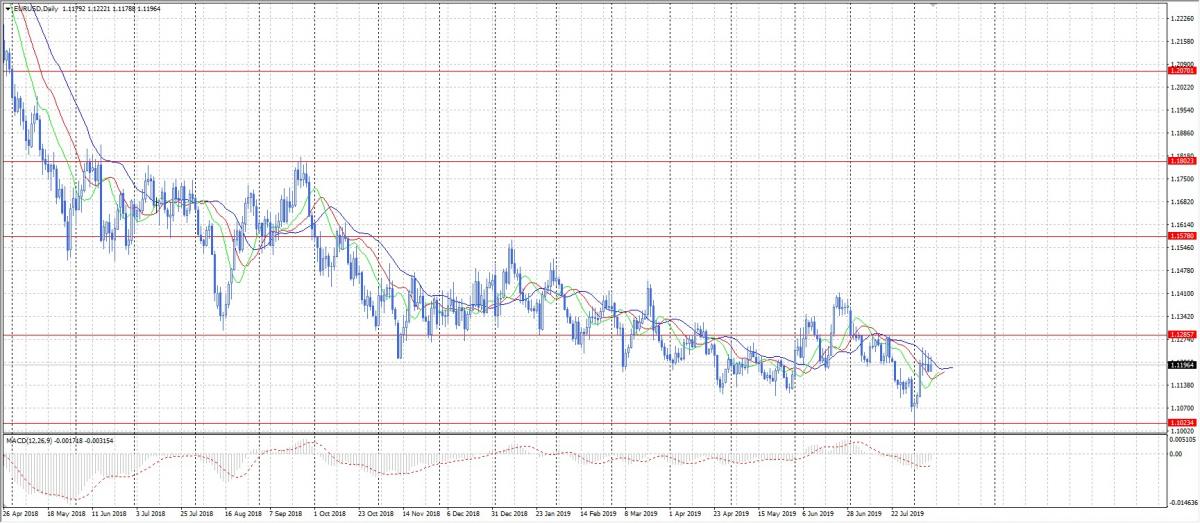

We have some reversal signals on the Daily chart. We expect EUR/USD to decline towards the closest support at 1,1023. If those signals are broken, the currency pair is likely to develop its way to 1,1285.