The currency pair developed its downtrend last week despite positive data from the Eurozone. EUR/USD’s decline was fueled by the decision of the ECB to hold the interest rates at 0 levels.

ECB members have mentioned on Thursday that they are going to continue this 0 rates monetary policy until inflation reaches 2% target level.

As for the other data releases, they were positive but had almost no influence on EUR. Friday’s PMIs were green excluding French and Eurozone’s Services indexes.

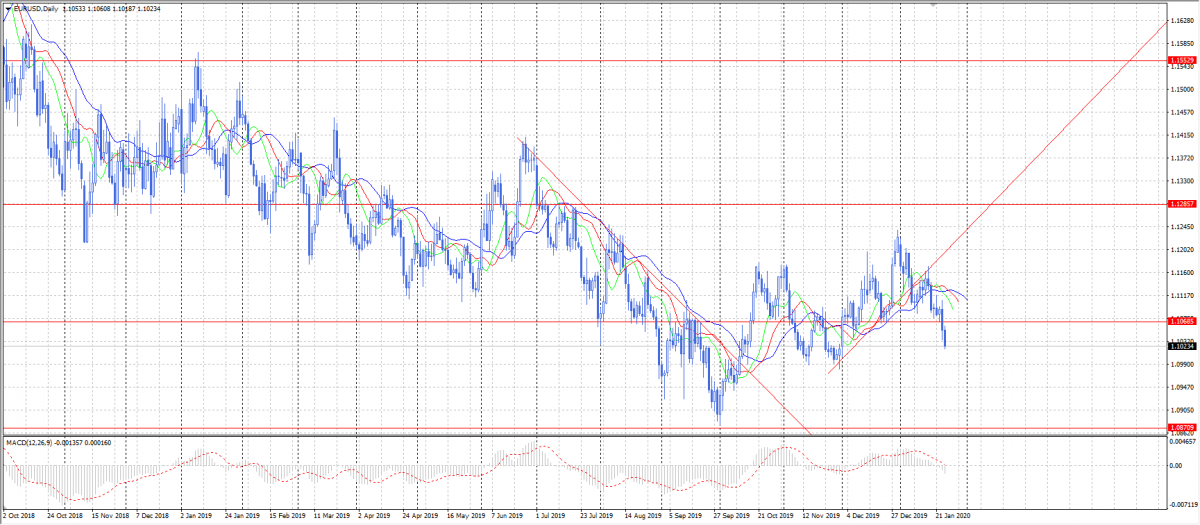

EUR/USD is likely to develop its downtrend towards the lows from November 2019 at 1,0980. If they are broken, the currency pair is able to develop its decline to 1,0870. In the case of reverse, EUR/USD is going to move towards the closest resistance at 1,1068.